working capital turnover ratio calculator

Generally a higher ratio is better and suggests that the company does not require more funds. Business owners accountants and investors all use working capital ratios to calculate the available working capital or readily available financial assets of a business.

Efficiency Ratios Archives Double Entry Bookkeeping

This ratio is especially important during a.

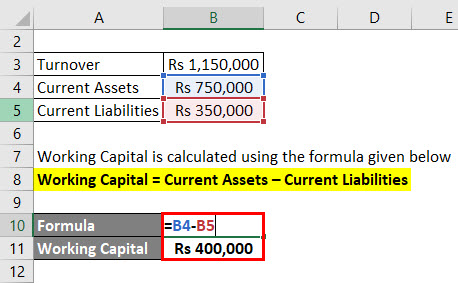

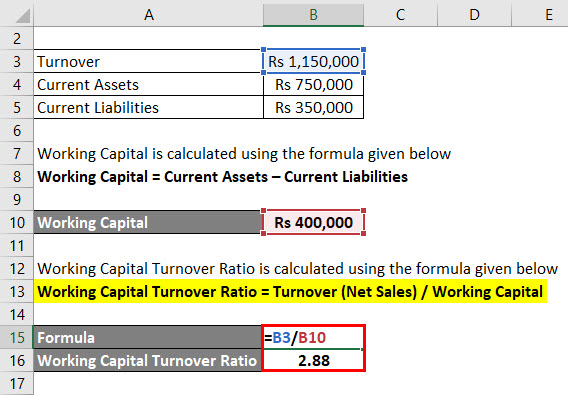

. This means that for every 1 spent on the business it is providing net sales of 7. Example of a Working Capital calculation. Now working capital Current assets Current liabilities.

Apply Now Get Low Rates. Working Capital Turnover 190000 95000 20x. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach.

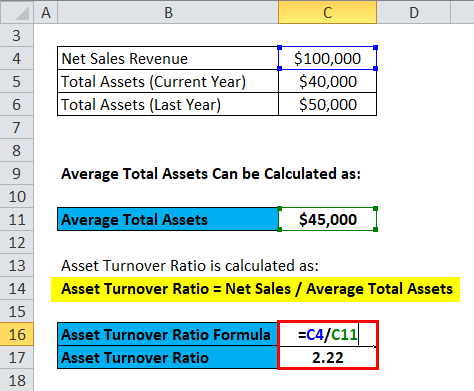

But an extreme higher ratio may also have drawbacks attached to it. 100000 40000. Check out our trade and receivables financing options.

If a business has 900000 in current assets and 500000 in current liabilities its working capital would be 400000. To arrive at the average working capital you can sum. Working Capital turnover ratio indicates the velocity of the utilization of net working capital.

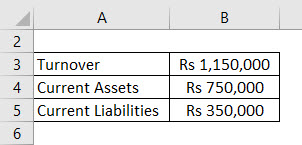

Turnover rate employees who left employees at the beginning of given period employees at the end of given period 2 100. Similarly a lower ratio depicts poor management of short-term funds. 15000050000 31 or 31 or 3 Times.

Example Of A Working Capital Calculation. Lets say over the last year 9 people left a company which had an average of 91 employees over that time. Together with ratios such as inventory.

The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. This means that XYZ Companys working capital turnover ratio for the calendar year was 2.

You can monitor the Working Capital Turnover Ratio to make sure you are optimizing use of the working capital. This ratio would be indicating that the company is struggling to. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue.

When a companys accounts payable are extremely high the working capital turnover indicator may be deceiving. An increasing Working Capital Turnover is usually a positive sign showing. Once you know your working capital amount divide your net sales for the year by your working capital amount for that same year.

Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC. A higher working capital turnover ratio also means that the operations of a company are running smoothly and there is a limited need for additional funding. About Working Capital Turnover.

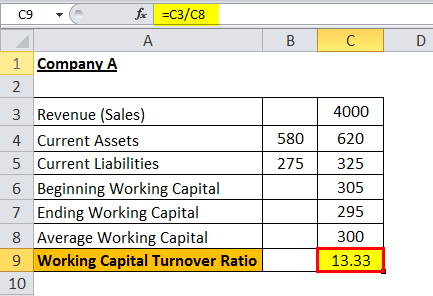

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times. The formula to determine the companys working capital turnover ratio is as follows. Venture Debt is a financing structure similar to that of a traditional bank loan.

Now that you know how to calculate turnover rate lets go through a short example. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. A high Working Capital Turnover ratio is a significant competitive advantage for a company in any industry.

150000 divided by 75000 2. The working capital turnover ratio denotes the ratio between a business net revenue or turnover and its working capital. The working capital turnover ratio calculation ignores disgruntled employees or economic downturns both of which can have an impact on a companys financial health.

Working capital can be calculated by subtracting the current assets from the current liabilities like so. What is the working capital turnover ratio for Year 3. Working Capital Current Assets - Current Liabilities.

However if the ratio is extremely high over 80 percent it could mean that the business doesnt have enough capital to support expansion and sales growth. How to calculate a working capital turnover ratio. It requires fixed monthly interest.

From the 20x working capital turnover ratio we can conclude that the business generates 2 in net sales for each dollar of net working. Now that we know all the values let us calculate the Working capital turnover ratio for both the companies. A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations.

Company B 2850 -180 -158x. Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already. The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result.

For example if a businesss annual turnover touches 15 lakhs and average working capital 3 lakhs the turnover ratio is 5 1500000300000. Company A 1800340 20x. What is Capital Turnover.

Its an important marker because it can be used to gauge the. This ratio measures the efficiency with which the working capital is being used by a firm. Example of the Working Capital Turnover Ratio.

The resulting number is your working capital turnover ratio. This ratio indicates the number of times the working capital is turned over in the course of a year. Ad Compare Top 7 Working Capital Lenders of 2022.

This shows that for every 1 unit of working capital employed the business generated 3 units of net sales. What this means is that Company A was more efficient in generating Revenue by utilizing its working. Working Capital Current Assets Current Liabilities.

A higher working capital turnover ratio is better and indicates that a company is able to generate a larger amount of sales. We calculate it by dividing revenue by the average working capital. 420000 60000.

Revenue-Based Financing provides company with working capital in exchange for a percentage of future monthly revenue. The calculation of its working capital turnover ratio is. Capital turnover is the measure that indicates an organizations efficiency about the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital employed.

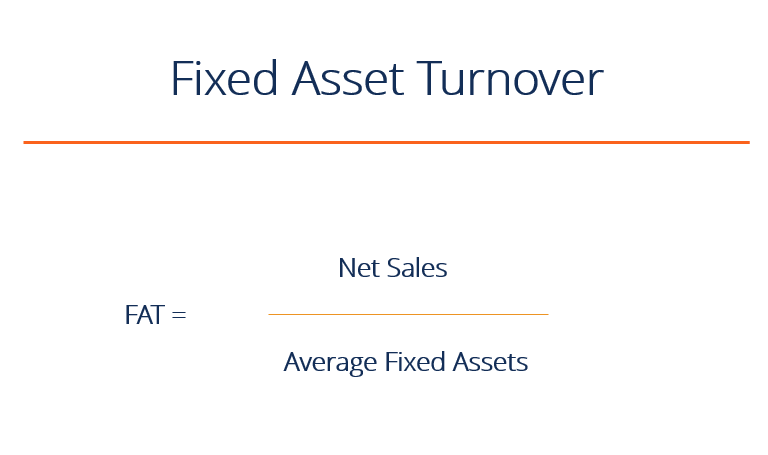

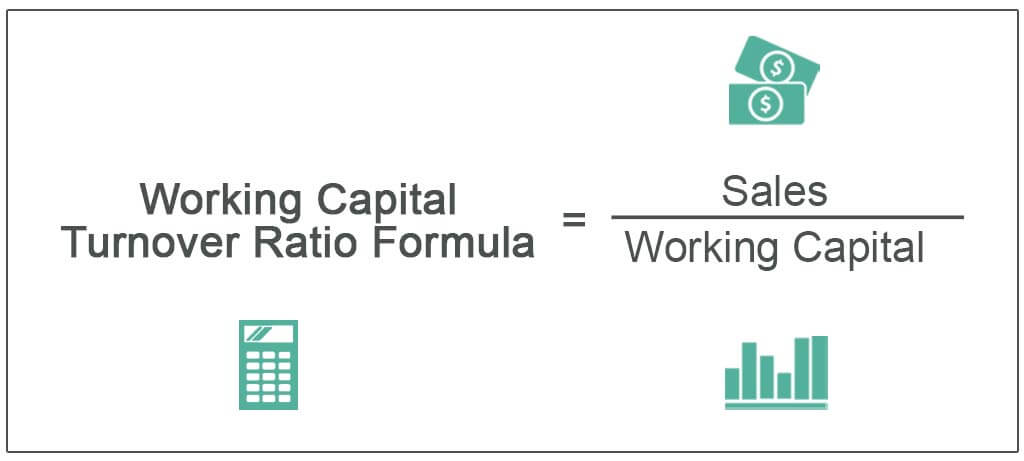

The formula to measure the working capital turnover ratio is as follows. Interpreting the Calculator Results If Working Capital Turnover increases over time. The working capital turnover calculator helps in determining the efficient working of this by the management.

Putting the values in the formula of working capital turnover ratio we get. A high working capital turnover ratio also gives the company an edge over its competitors. Working capital turnover ratio Net Sales Average working capital.

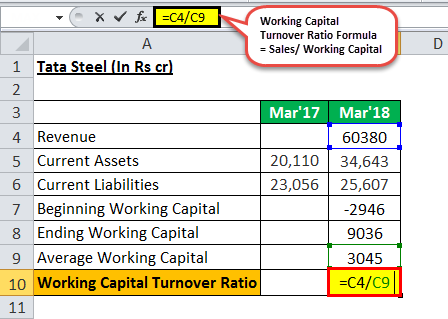

Average working capital would be the average of 20000 and 24000. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. Working capital Turnover ratio Net Sales Working Capital.

Working Capital Turnover Ratio Net SalesWorking Capital. WC Turnover Ratio Revenue Average Working Capital.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Fixed Asset Turnover Overview Formula Ratio And Examples

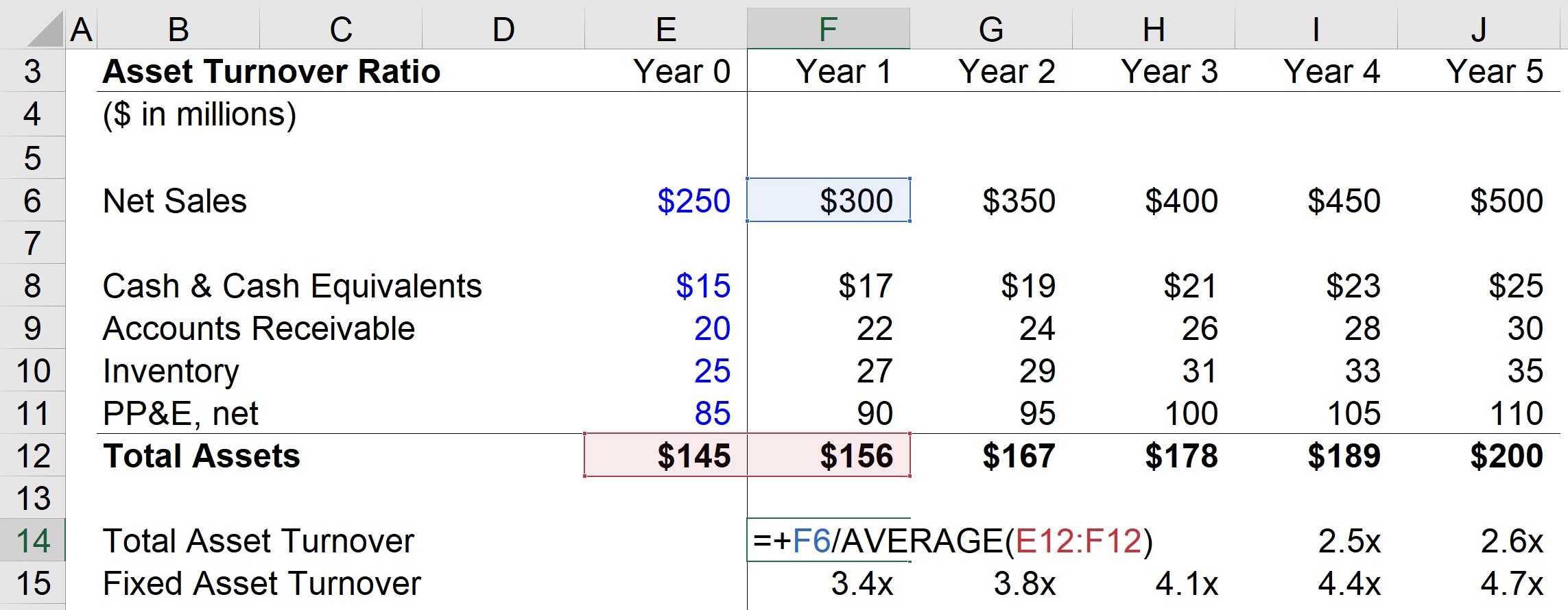

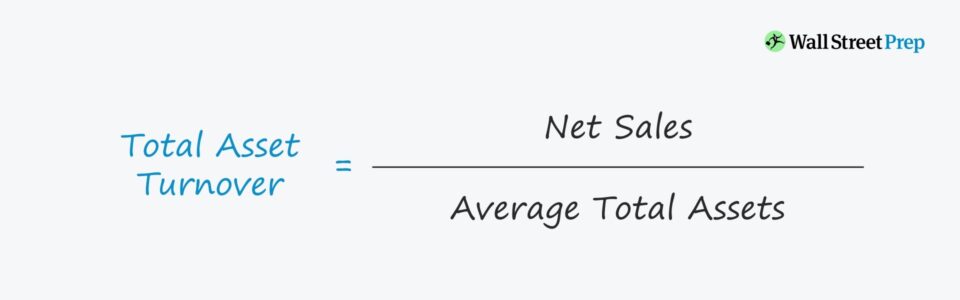

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Calculate Working Capital Turnover Ratio Flow Capital

Asset Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Calculator

Efficiency Ratios Archives Double Entry Bookkeeping

Asset Turnover Ratio Formula And Excel Calculator

Asset Turnover Ratio Formula Calculator Excel Template

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template